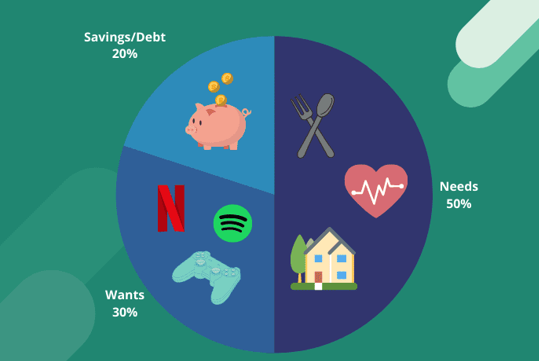

Achieve Financial Balance with the 50/30/20 Rule:

Reaching the age of 40 often comes with increased responsibilities and financial challenges. From managing a family to planning for retirement, striking the right balance between expenses, savings, and debt can seem daunting. However, there’s a simple and effective tool that can help you take control of your finances and secure a brighter future—the 50/30/20 rule.

What is the 50/30/20 Rule?

The 50/30/20 rule is a popular budgeting strategy designed to streamline your finances by allocating your after-tax income into three main categories: needs, wants, and savings/debt repayment. By adhering to this rule, you can create a balanced financial plan that ensures you cover essential expenses, enjoy life’s pleasures, and build a strong financial foundation for the future.

- Needs (50%):

The first step in financial stability is taking care of your essential expenses. This category covers the necessities that you must pay for to maintain a comfortable and stable lifestyle. It includes:

- Housing: Rent or mortgage payments, property taxes, and utilities.

- Food: Grocery bills and other essential household supplies.

- Transportation: Car payments, insurance, fuel, and public transportation costs.

- Health: Medical expenses and insurance premiums.

- Insurance: Coverage for life, disability, or other essential insurance policies.

Allocating 50% of your income to meet these needs ensures that you have a solid foundation and stability in your daily life.

- Wants (30%):

Life is meant to be enjoyed, and the 30% category is all about fulfilling your desires and enjoying discretionary expenses. Here, you have the freedom to spend on things that bring joy and satisfaction. This category includes:

- Dining out: Treat yourself and your loved ones to meals at restaurants or cafes.

- Entertainment: Tickets to movies, concerts, sports events, and other leisure activities.

- Travel: Planning vacations and exploring new destinations.

- Hobbies: Pursuing activities you’re passionate about, such as fitness classes, art, or sports.

By allocating 30% of your income to wants, you strike a balance between responsible financial planning and making room for personal enjoyment and growth.

- Savings and Debt Repayment (20%):

The final category focuses on securing your financial future by building savings and paying off debts. This critical 20% should be directed towards:

- Emergency fund: Establishing a savings buffer to handle unexpected expenses.

- Retirement savings: Contributing to retirement accounts.

- Debt repayment: Tackling credit card debt, student loans, or other outstanding loans.

Investing in yourself and your financial well-being is crucial to achieving long-term stability and security.

The 50/30/20 rule offers a simple and practical approach to budgeting, allowing you to make informed financial decisions and find peace of mind. Take charge of your financial journey now, and your 40s will be a decade of growth, security, and contentment. Remember, it’s never too late to start taking control of your financial destiny!

The best option for finance your dream house: www.SeaportCredit.ca